1. Making Tax Digital - Software Suggestions

Why MTD matters for cake business owners:

-

📊 Digital record-keeping – no more piles of paperwork; all records stored securely online.

-

⏱ Time-saving – automated calculations and easy submissions mean less stress and more focus on baking.

-

✅ Accuracy – digital records reduce errors and keep HMRC happy.

-

💡 Real-time insight – understand profits, costs, and cash flow instantly.

-

🌟 Compliance made simple – meet HMRC requirements without headaches.

Software explained and compared:

During the presentation, David will cover and assess key accounting software options for UK cake businesses:

-

QuickBooks, Xero, Sage, and QuickFile

-

Comparison of cost, ease of use, and reporting capabilities

-

Practical guidance on which software suits your business size, style, and workflow

Making Tax Digital (MTD) – Simplifying Your Cake Business Finances

Running a cake business in the UK can be rewarding, but keeping on top of your tax and finances is often stressful. Making Tax Digital for Cake Business Owners sets out to help understand the government-backed system designed to make your accounting simpler, more accurate, and fully digital. David Brice from CakeFlix will guide cake business owners through MTD in a practical, easy-to-follow presentation, showing exactly how it can save you time, reduce stress, and give you a clearer picture of your business.

Why MTD matters for cake business owners:

-

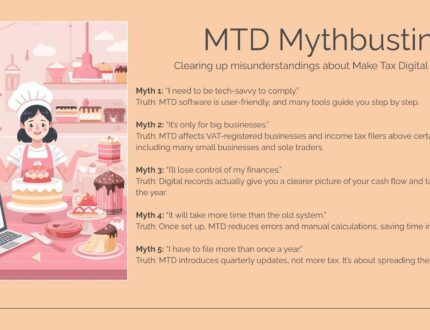

📊 Digital record-keeping – no more piles of paperwork; all records stored securely online.

-

⏱ Time-saving – automated calculations and easy submissions mean less stress and more focus on baking.

-

✅ Accuracy – digital records reduce errors and keep HMRC happy.

-

💡 Real-time insight – understand profits, costs, and cash flow instantly.

-

🌟 Compliance made simple – meet HMRC requirements without headaches.

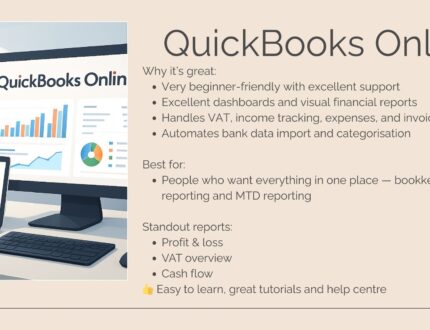

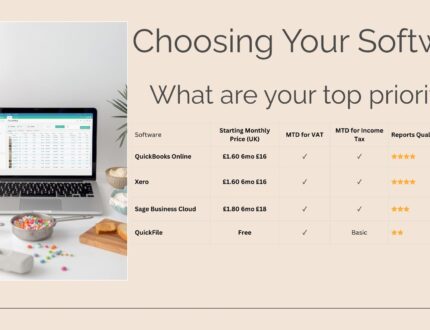

Software explained and compared:

During the presentation, David will cover and assess key accounting software options for UK cake businesses:

-

QuickBooks, Xero, Sage, and QuickFile

-

Comparison of cost, ease of use, and reporting capabilities

-

Practical guidance on which software suits your business size, style, and workflow

What you’ll gain:

-

Clear understanding of MTD and how it works for cake businesses

-

Practical knowledge of which accounting software is best for you

-

Confidence to keep digital records, submit VAT, and track finances efficiently

Making Tax Digital isn’t just a requirement – it’s an opportunity. By embracing digital accounting, you free up time, reduce errors, and make smarter business decisions while focusing on what you love most: creating amazing cakes.

Share any questions you might have on the CakeFlix PRO on our Facebook group.

View hundreds of more world-class tutorials only at www.cakeflix.com.